As promised, a quick word about inflation linkers in emerging markets.

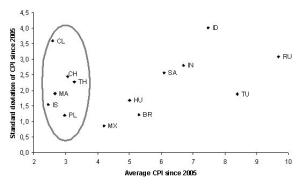

While in most cases, the path of inflation in the coming 3-6 months is pretty much given; many economies are a completely different level of their respective inflation rates. Importantly, volatility of inflation rates also differs wildly. Take the following chart as and example. It shows the relationship between average inflation since the beginning of 2005 (so around 100 observations) and the standard deviation of CPI in the same time-frame.

As you can see, there is a group of emerging economies which have achieved a relatively low level of inflation (the circled part of the chart) but they have had mixed success in terms of staying close to the average. Arguably, Israel, Malaysia and Poland are the best in this field.

As you move to countries with higher average inflation rates, standard deviation tends to rise. However, note that we are talking here in percentage points, as opposed to normalised values. In other words, we say that Poland is “better” than Turkey just because it has had a lower average and a lower standard deviation. However, if you normalised standard deviation by dividing it by the average you will see that Turkey has been much closer to its average than Poland. We will use that in a minute.

The chart below combines the approach of the volatility in inflation rates (i.e. standard deviation divided by the average) with the distance of the latest CPI print from respective central banks’ targets (note that for some countries I had to make assumptions as their central banks are not inflation targeters).

In this chart we see, for example, that South Africa is 1.2pp above the 4.5% target (mid-point of the 3-6% SARB range) and that standard deviation of CPI prints since 2005 has been around 40% of the average (which was 6.1%).

How to trade this? Someone could ask what the point of looking at such a chart is. Well, as worries about inflation resurface along with some acceleration in growth rates, investors will be willing to bet that some emerging economies could have their inflation rates moving up fast. At the same time, the central banks would have to respond. Therefore, I think that what we’re looking for is countries, which

- currently have inflation below (or close to) the central bank’s target

- have experienced significant volatility of inflation prints in the past.

In those economies you should consider looking at inflation linkers or shorting nominal bonds.

When using such a comparison, Chile stands out as a good candidate with low current inflation and high inflation volatility. Similarly, Israel has a history of quite rapid moves in inflation rates and we also can be reasonably sure that the output gap there is insignificant. Finally, Poland is looking at rapid declines in inflation rates at the moment, mathematically increasing odds of a rebound in the second half of the year and indeed in 2014.

There are also many caveats to this approach but I have found it to be a useful starting point when trying to play a global inflation / disinflation theme.